2024 Budget Update

The core of the 2024 New Zealand Budget is tax relief for working families and restrained public spending. Households anxious about cost of living and job security make cautious consumers. Businesses coping with rising overheads and shrinking retail spends tend to tighten up to maintain cash flow. Changes to the bright-line test and interest deductibility made it easier for property investors but removal of the First Home Grant makes it harder for first home buyers. If we can cool inflation during the second half of the year, interest rates might cool too. It is hoped that the boosts to the back pocket and to families will inject a bit more optimism in the meantime.

Tax threshold changes and your business

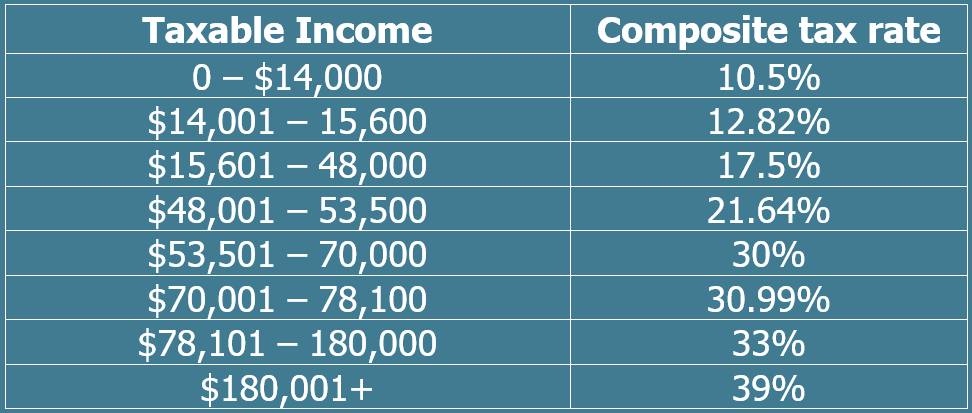

Businesses need to note that the current thresholds apply for the first 3 months and 30 days of the 2024–25 tax year; the new thresholds for the remaining period. For the

2024-25 year only, composite tax rates will apply:

Employers need to ensure their payroll providers make the necessary changes to their systems for 31 July.

The tax threshold changes have a knock-on effect on fringe benefit tax (FBT), employer superannuation contribution tax (ESCT), retirement scheme contribution tax, RWT and prescribed investor rates.

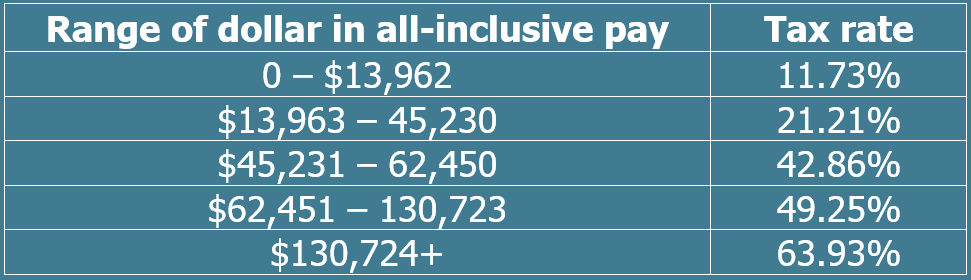

The new thresholds for FBT which effectively apply from

1 April 2025 are (noting that for the year beginning 1 April 2024 a new attribution method formula effectively accounts for the newly introduced income tax thresholds):

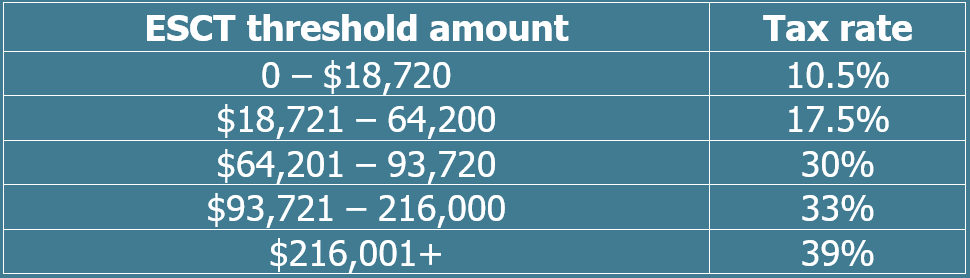

The proposed thresholds for ESCT applying from 1 April 2025 are:

The Back Pocket Boost:

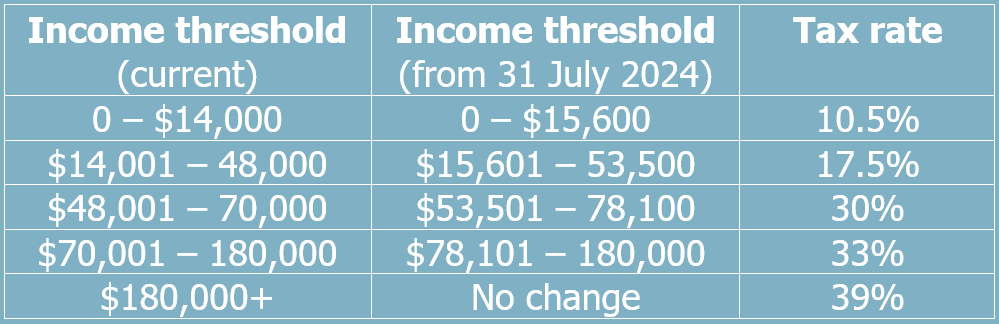

Changes to personal income tax thresholds take effect from 31 July. This is designed to give New Zealanders some breathing space after several years where higher wages dragged them into higher tax brackets due to inflation.

Other Tax Credits and FamilyBoost:

Comparable to the extension of the personal income tax rate thresholds is the change to the independent earner tax credit (IETC). It’s currently available for people earning between $24,000 and $48,000 per year (providing a tax credit of up to $20 per fortnight). From 31 July 2024, the upper income limit will be extended from $48,000 to 70,000 per year, although it starts to be reduced when a person earns more than $66,000 per year.

The in-work tax credit supporting low-to-middle income working families with children will also increase by up to $50 fortnight from 31 July 2024.

From 1 July 2024, FamilyBoost, a new childcare rebate, will be administered by Inland Revenue. Eligible families will be able to obtain a reimbursement for up to 25% of their early childhood education (ECE) fees, up to a maximum of $150 per fortnight (taking into account the 20 hours of ECE and the Ministry of Social Development’s childcare subsidy). The maximum amount per fortnight reduces for families with incomes over $140,000 per year. Families with incomes over $180,000 are not eligible.

Infrastructure, resilience and housing:

Budget 2024 invests $1.2 billion over three years in a new Regional Infrastructure Fund covering:

· flood protection and energy security projects, including schemes to protect agricultural land

· projects supporting increased productivity in regional economies

First in line are areas still recovering from Cyclone Gabrielle such as the East Cape region and parts of Northland.

A 30-year National Infrastructure Plan and National Infrastructure Agency are also being established to expedite development across road, rail and public transport, educational institutions, defence capability, prison facilities and social housing.

The First Home Grant will be scrapped, the funding going towards an additional $140m for social housing.

Health and Education:

The Budget allocates $3.4b for hospital and specialist services and $2.1b for primary care, community and public health through Health New Zealand. $1.77b is allocated to Pharmac. The free breast screening programme for women aged

45 –69 will be extended to include women up to the age of 74. The Gumboot Friday initiative will receive $24m to provide young people with free mental health counselling. The Government also pre-commits funding over the next two budgets to help the sector plan and invest for frontline healthcare delivery and workforce retention.

The $5 fee for prescriptions is back for most people from 1 July, with exemptions for under-14s, over 65s, Community Services Card holders and their dependents who are 14–17-years old.

For education, $2.9b in new funding is set aside over the next four years, including:

· $1.5b for building new schools and classrooms and maintaining and upgrading existing ones

· $163m for IT infrastructure and services in schools

· $478m to continue the Healthy School Lunches Programme for another two years

At tertiary level, the first-year fees free policy is being replaced with a final-year fees free policy. Interest rates on student loans will increase by 1% for five years for people overseas from 1 April 2025.

Contact us if you would like to discuss the impact on your business systems, including your FBT programme. If you earn interest or dividends or if you pay business related interest to family and friends, please talk to us.